binance tax forms reddit

Does Binance US provide tax forms or report transactions to IRS. The IRS states that US taxpayers are required to report gains and losses or income earned from crypto rewards based on certain thresholds on their annual tax return Form 1040.

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

Click on the link to view your API key and.

. Open the BinanceUS app and tap the User Profile icon on the bottom navigation bar. The only option I found was exporting the trade history as a excel file so maybe thatll be enough. If you do this through an exchange you better count on the IRS finding out.

We have integrated Binance via API on BearTax with which one can consolidate trades review depositsreferrals calculate capital gains and download tax forms within few minutes. This is the first time the Indian government is discussing crypto taxation. As it stands right now crypto is an asset especially if youre using it to make profits.

Hello I am a tax resident of germany and have various crypto buy orders on binance from 2017-2019. FRMS to USD price is updated in real-time. I have this same question.

Here is a step by step procedure on how to get your tax info from Binance. The US Internal Revenue Service says its ready to give a cash reward of 625000 to anyone who cracks Monero XMR and other privacy coins that aim to make financial transactions. What do you guys think if Binance can offer tax forms directly to its customers without asking tax ID details and freaking them out.

Capital losses may entitle you to a reduction in your tax bill. Does Binance US provide tax forms or report transactions to IRS. Log In Sign Up.

You will be emailed a link to confirm your API Key. How to get Binanceus crypto API tax to upload properly. It will be very difficult to expect binance to give me transactions that i.

Log in to your Binance. Crypto back to USD yes. Press question mark to learn the rest of the keyboard shortcuts.

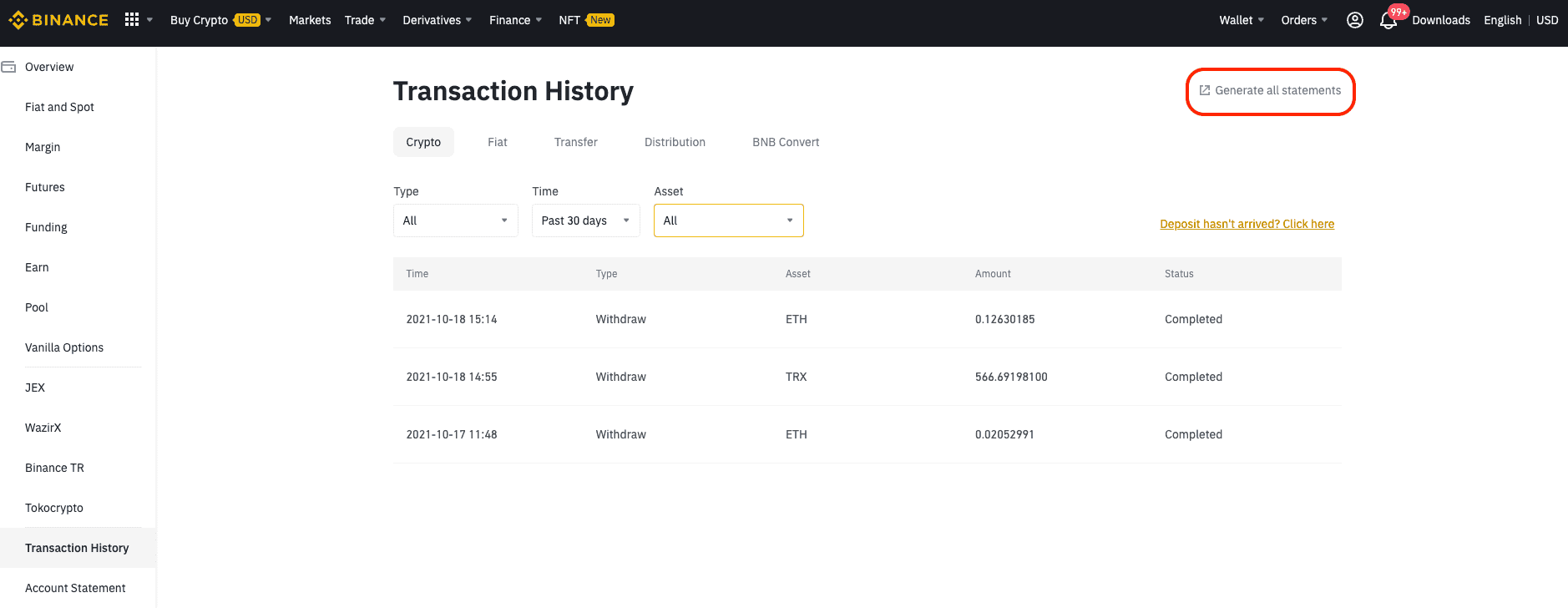

Report Inappropriate Content. Especially when you are dealing in so many decimals of whole units and the fees are in a totally different currency from the actual trading pair. Binance will be launching the Tax Reporting Tool at 2021-07-28 0400 AM UTC a new API tool to allow Binance users to easily keep track of their crypto activities in order to.

Name your API Key and click Create New Key button. How to generate your Tax API Key on iOS or Android. Firstly click on Account - API Management after logging into your Binance account.

The IRS states that US taxpayers are required to report gains and losses or income earned from crypto rewards based on certain thresholds on their annual tax return Form 1040. The tax will apply to all gains on digital. The most important thing in terms of Binance tax documentation is the quarterly reports you get on your activity on the exchange.

Thats like 3 different. One of the largest crypto exchanges worldwide - Binance helps millions of crypto investors buy sell and trade crypto. Koinly is a Binance tax calculator reporting tool.

I want to extract a offical pdf for the tax agency in germany so my question is if there is a official way to produce one. What I dont understand is why binance global prohibits US-based users I assume this is so binance can. Really hoping someone has a definitive answer.

Binance Tax Documents and Forms. Press J to jump to the feed. Buying goods and services with crypto.

Sign in to BinanceUS API Management. Download schedule d form 8949 us only reports and software imports eg. Binance tax forms reddit.

Scroll down and tap Tax Statements. Indian government just announced that crypto will be taxed at 30 of gains. Imagine if Binance establishes partnership with us and has this capability.

Go and connect your Binance US account to contrackerio and then connect turbo tax. 2022-04-19 - The live price of FRMS is 00064638 per FRMS USD today with a current market cap of 0 USD. We will file a Form 1099-K with the IRS and in some cases certain state authorities to report transactions by BinanceUS customers in each year where we are required to do.

24-hour trading volume is 0 USD. If you need to file taxes for your cryptocurrency investments you can generate a statement of your Binance account to perform tax calculations. Its pretty hard to avoid your tax department finding out you have crypto considering you verify your account on exchanges.

If you use Bitcoin to pay for any type of good or service this will be.

Pin En Cryptocurrency Latest News

How To Obtain Tax Reporting On Binance Australia Frequently Asked Questions Binance Support

The Complete Pancakeswap Taxes Guide Koinly

Best Crypto Tax Software 10 Best Solutions For 2022

Does Binance Us Report To The Irs

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

How To Obtain Tax Reporting On Binance Australia Frequently Asked Questions Binance Support

I Ve Tried Crypto Tax Software So You Don T Have To R Cryptocurrency

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

How To Obtain Tax Reporting On Binance Australia Frequently Asked Questions Binance Support

New Upgraded Tax Reporting Tool R Binanceus

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

3 Steps To Calculate Binance Taxes 2022 Updated